Our Journey

How We Started Sugmya

Sugmya Finance Pvt Ltd was incorporated in 2017, marking the beginning of a journey dedicated to providing financial solutions to individuals and businesses. In January 2019, we obtained our NBFC license, solidifying our commitment to the financial sector.

Our operations commenced from our headquarters in Delhi in 2019, focusing initially on short-term personal loans and personal loans. As we continued to expand our offerings and reach, our NBFC-Micro Loan vertical was launched in July 2020, with the inauguration of our first branch office in Amlaha, Madhya Pradesh.

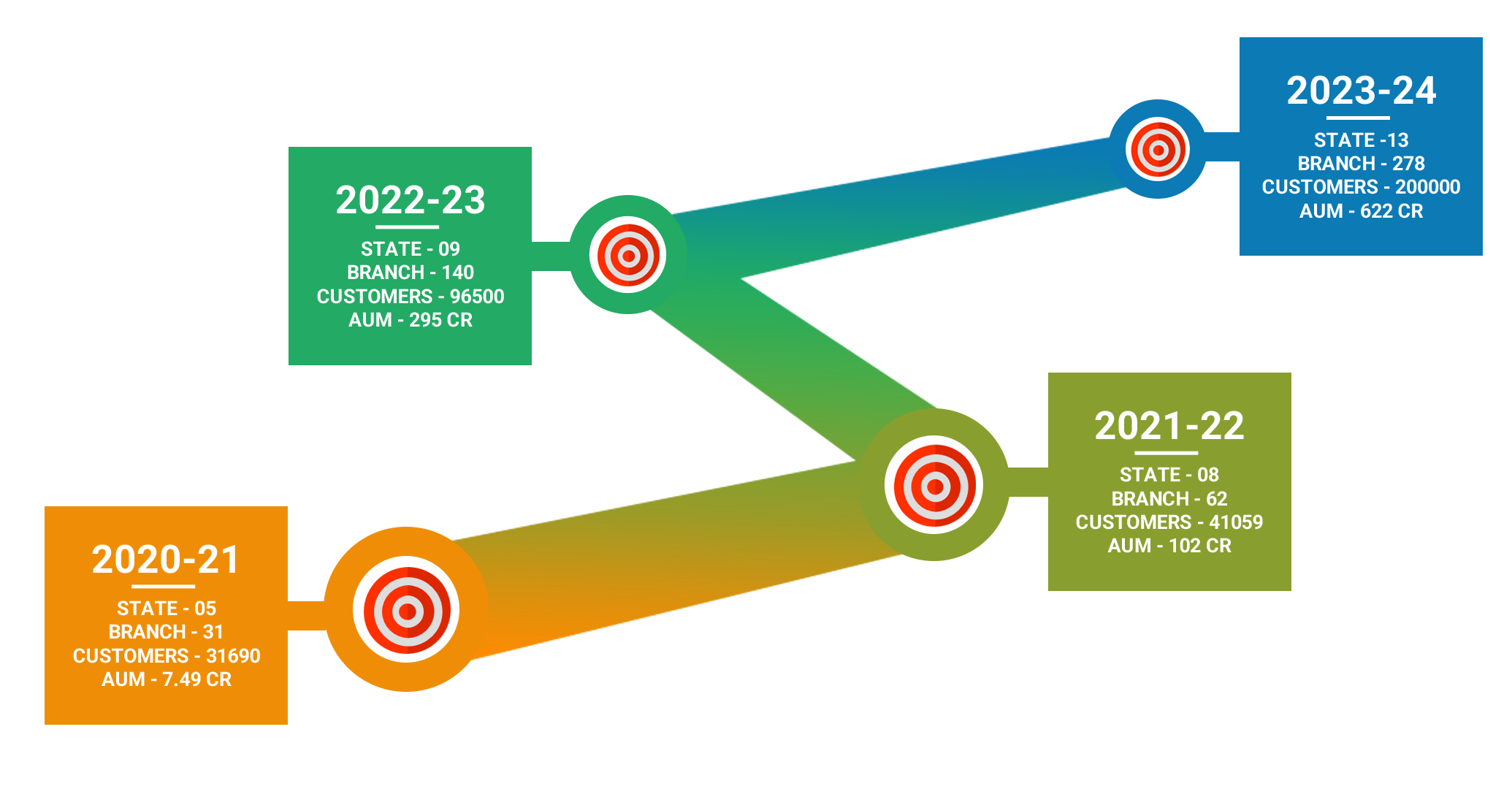

Driven by our vision and dedication, Sugmya Finance Pvt Ltd experienced rapid growth and expansion. Within a short span of time, we have established our presence in 13 states across the country, with a network of 278 branches. This exponential growth is a testament to our commitment to providing accessible financial services to individuals and communities nationwide.

As we continue to grow and evolve, Sugmya Finance Pvt Ltd remains steadfast in our mission to empower our customers with financial solutions that meet their needs and aspirations, while upholding the highest standards of integrity, transparency, and customer service.